Can Q-Commerce be Profitable Ever? Optimizing Processes to Drive Profitability 🧪

There have been a lot of debates regarding profitability in the QCommerce Business Model all over LinkedIn with many people criticizing the current business model of these startups with a special focus on lack of profitability. In the previous article, we gave you a deep dive into the business model of the Q-Commerce business Model and asked you to decide for yourself whether it's profitable or not.

In this article, we will take a deeper dive into the model and see how we can drive profitability by optimising the business model.

The problem with Q-Commerce is not attaining profitability but how quickly one can crack the formula and attain profitability faster because in Q-Commerce speed is everything and burning cash is mandatory if you want to survive but doing that intelligently is what matters the most.

What is the first step towards achieving profitability?

📍 Positive Unit Economics!

In the secret sauce of success, positive unit economics plays the role of a vital ingredient and here you will get to see why Q-Commerce is not made for some markets.

When do you use QCommerce?

Essentially, there can be two use cases for QCommerce

- You are cooking something and 2 to 3 things are missing. You go and order that thing that results in a small basket size and low order value

- You don’t have the capacity to store some things and you know you can order them whenever you need them. Guess what? Small Basket size again

Now, the question is why small basket size is an issue?

Small Basket size => Lesser Average Order Value => No to Very Low-Profit Margin

What are the possibilities to attain profitability then?

We can solve this problem using different views. Let’s talk about each one of them one by one.

- Increasing the Revenue

- Decreasing the Costs

- Introducing Multiple Revenue Streams

1. Increasing the Revenue 💰

a. Increasing the Order Value 🚀

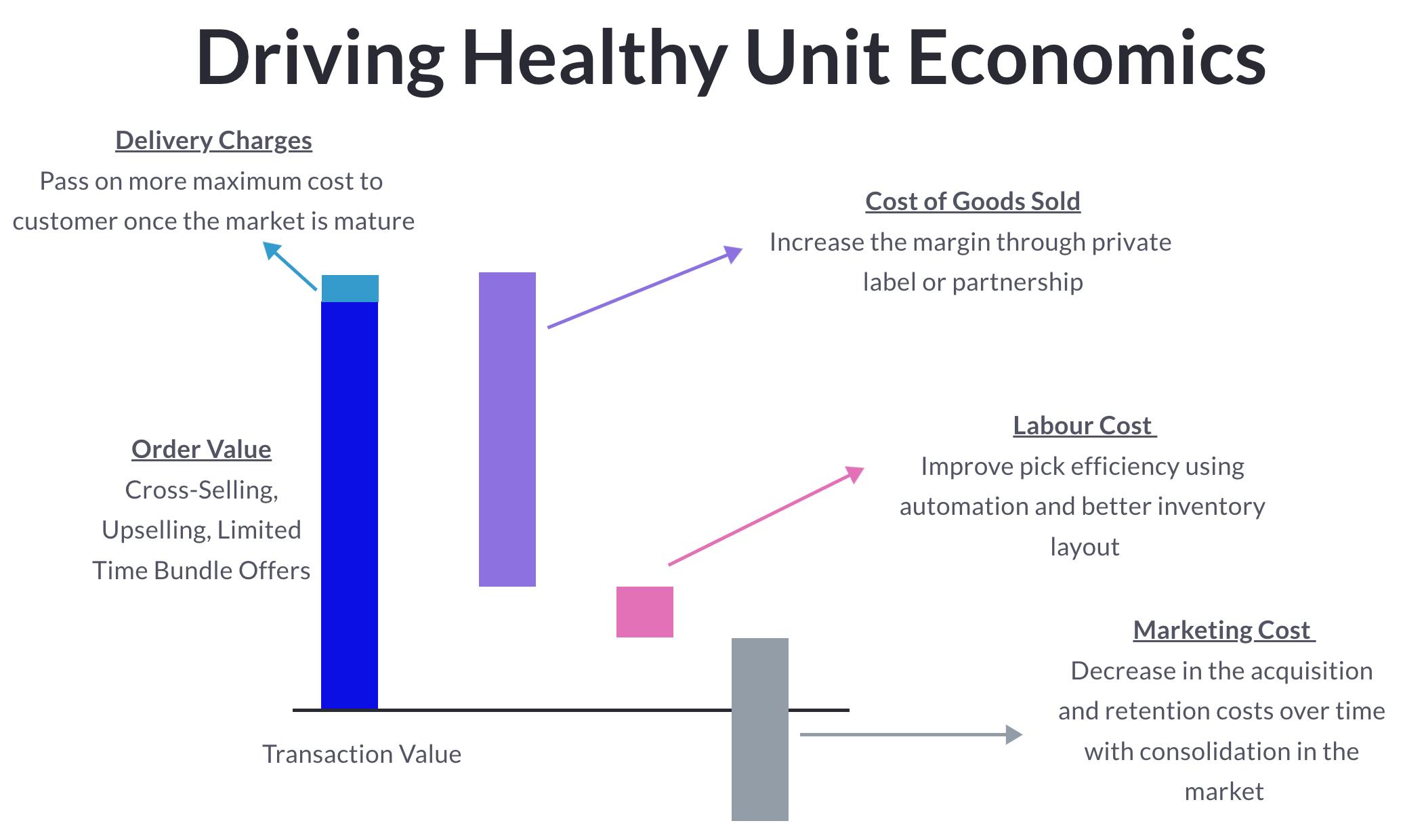

Increasing the order value is a tough game as QCommerce already operates on a limited number of SKUs and increasing the SKUs might affect their picking and delivery efficiency. However, it can be achieved after rigorous testing of which products works and which don’t. There are a few techniques like cross-selling, upselling, personalizing the experience using recommendation algorithms, and introducing limited-time bundle offers.

b. Increasing the Delivery Charges 🚚

Right now, more than 50% of the rider fee is covered by the companies themselves, and only minimal charges are paid by the customer but one day when the ecosystem consolidates and the competition reduces with the fastest cash burners dropping out, it may be possible to pass on the whole delivery cost to the customer. We cannot see this happening in the near future however it will eventually happen because this is what startups sell to VCs as well.

2. Decreasing the Costs 📉

a. Improving the Whole Sale Margin 🥂

Improving the wholesale margin means decreasing the cost of goods sold and hence increasing the profit per unit. It’s one of the key targets for QCommerce Businesses. It includes partnering up with brands to purchase goods directly from them instead of relying on wholesalers. Furthermore, companies are also introducing private label products (GoPuff recently introduced this) to drive higher margins. However, this can only be done with scale. Larger the scale, the larger the margins, and hence the quicker the profitability.

b. Improving Pick Efficiency 🤖

Improving Pick Efficiency means automating some processes and optimizing the layout of inventory in the dark stores. This is what QCommerce businesses often focus on. However, if we see the picking labor costs, it feels like optimizing these costs should not be the core focus of any company as these are just a small fraction of the whole waterfall and the process can be optimized only to a certain level.

c. Decreasing the Marketing Costs 📈

QCommerce businesses spend a lot on marketing to acquire and retain customers. However, this cost will eventually drop down when consolidation happens. Because every other QCommerce player is trying to create awareness and acquire customers but once there is just one player in the market there will be no need to create awareness and convince customers to use the platform because the customers will know the USP and minimum marketing would do the trick to retain them on the platform. But again, this would take time and we can’t expect it to happen in near future at least.

3. Introducing Multiple Revenue Streams 🧪

Recently, we have been seeing some Q-Commerce businesses introducing multiple revenue streams through partnering up with different businesses and entering into the ad-based revenue model. After reaching a certain scale in terms of the number of users and level of reach, QCommerce companies can easily utilize their platform to introduce ads on their platform intelligently through personalised recommendation algorithms. It will not only help the QCommerce companies earn money through partnerships but also help them establish a better brand value (that will also help in increasing basket value) and increase their chances of direct partnering up with businesses to increase margins as well.

Panda Mart started Nestle ads on their delivery screen recently and Krave Mart has recently announced ads based partnerships with businesses to drive profitability. It would be exciting to see these two companies driving profitability through this stream in the near future.

🔮 What does The Future look like for QCommerce Startups?

We can expect consolidation in the QCommerce market with many startups shutting down or getting acquired because it's the only way this market can mature. We can already start seeing this pattern with recent acquisitions and shutdowns in the global QCommerce space. VCs are also skeptical about this profit-challenged and hyper-competitive market and pressing startups to start showing profitability sooner than expected.

What other things do you think these startups should do to drive profitability and what do you think about this space in general? Write in comments and let us know your thoughts!