Photo by Frank Busch on Unsplash

Is Q-Commerce Profitable? Diving into the Unit Economics of Q-Commerce!

In the previous article, we tried to demystify the operational model of Q-Commerce startups. If you haven't read it yet, Click this link to read that article because in this article, we will be talking about business.

In this article, we will dive deeper into the Q-Commerce market, and try to understand the unit economics. But, first of all, lets see the market size of Q-Commerce. Right now, the global Q-Commerce market is valued at around $25B and is expected to grow to $72B by 2025. That means it is one of the most exciting industries to know about right now.

Now, let's dive into the unit economics of the Q-Commerce Startups

The Unit Economics is mainly divided into two categories i.e. Fixed Costs and Variable Costs.

Fixed Costs = Associated with the fixed assets on which the company operations are dependent.

Variable Costs = Changes with order value.

Variable Costs = Changes with order value.

Let’s see how revenue is calculated per order:

How can we measure the profits per order?

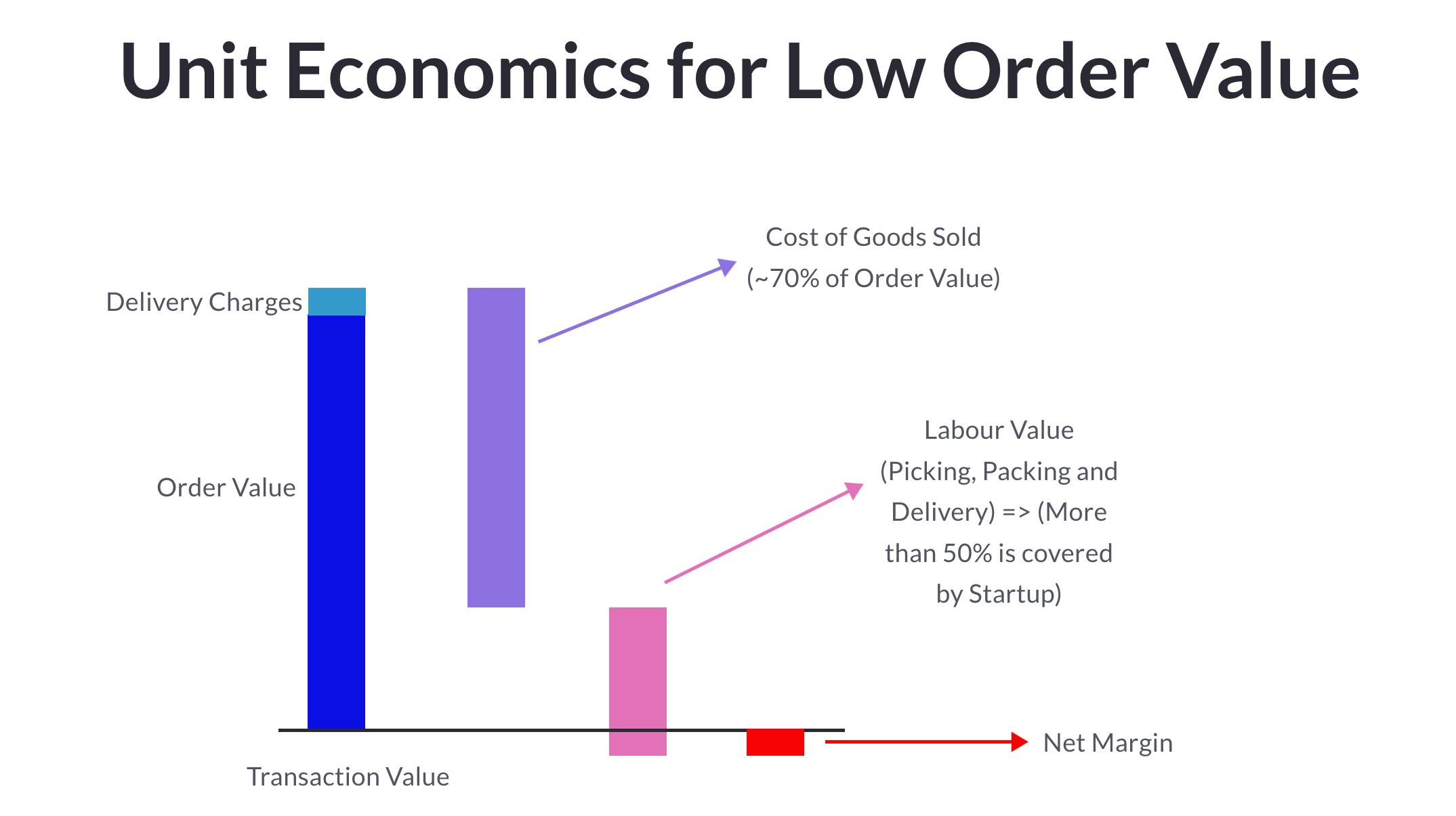

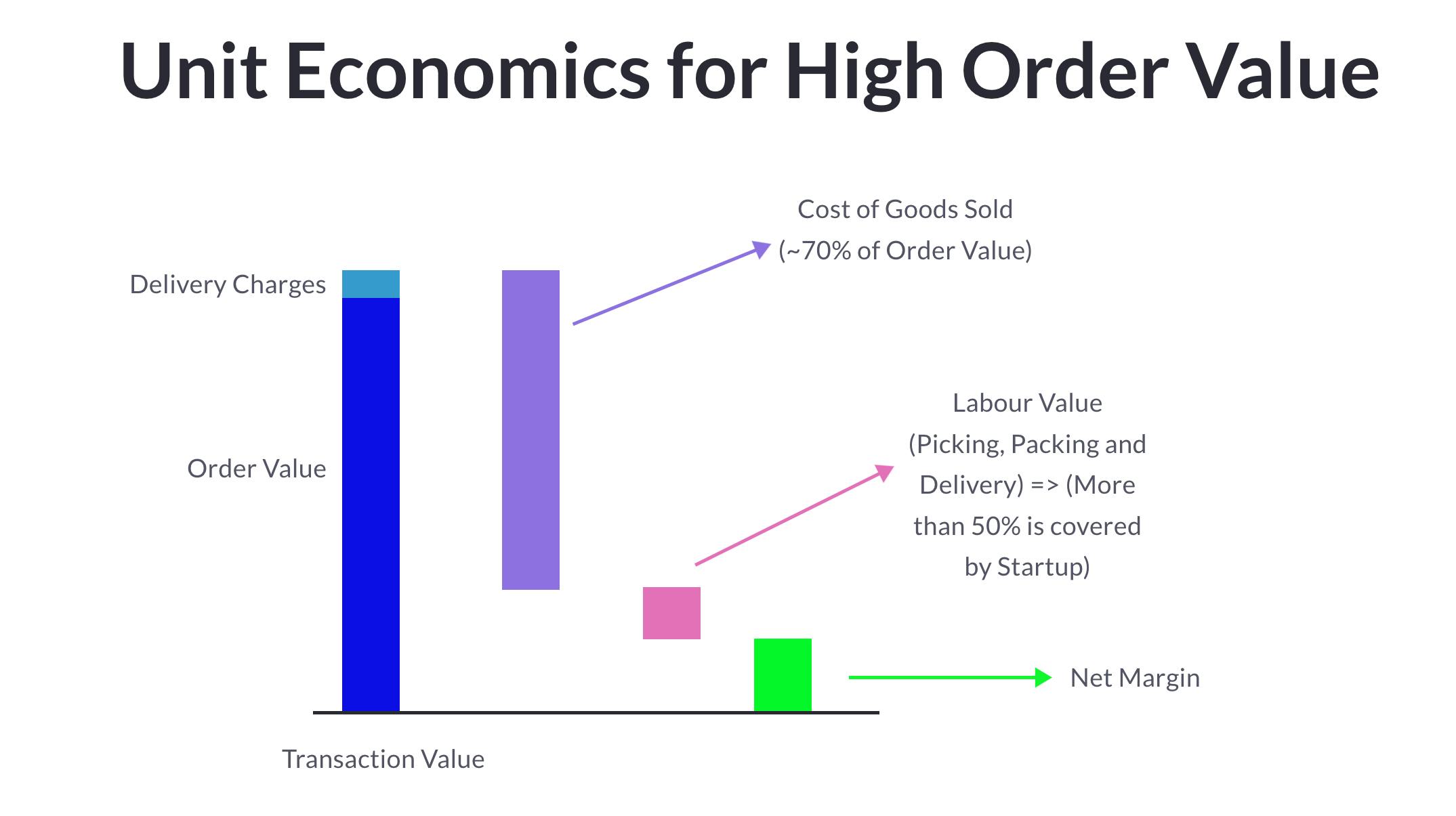

Order Value is the key player in this game. Higher order value results in healthy unit economics and profitability in the longer run, however, low order value results in negative net margin and further burdens the company.

What is Order Value btw?

Order value is the total price of goods in the basket.

Does it mean order value = Transaction Value?

Not Necessarily, sometimes, the company charges a delivery fee on top of the order value that increases the transaction value. However, the strategy is to waive off the delivery fee after a certain order value to increase the basket size.

What is Cost Of Goods Sold?

To understand this, you need to know that the amount that you pay as a customer is not equal to the amount that company pays to get that product. There is a margin that company keeps, and this is how the retailers also make profit.

Cost of Goods is the cost in which the company purchased the goods. The cost that is shown to us in the app is after applying a certain margin to it. The margin can vary from 8% to 40%, however the average margin is almost 30%. Hence, the cost of goods sold is almost equal to the 70% of the order value.

How are the Picking, Packing and Delivery Labor variable cost?

Picking, Packing, and Delivery Labour is Fixed per order, but if we see them through the percentage amount of an order, then, it will get dependent on the basket size and it will reduce, as the order value grows. The delivery fee charged to us as a customer doesn't cover the whole labour costs. More than 50% cost is covered by the company itself.

The Following two diagrams show how the Transaction value is broken down. Do keep in mind that the marketing costs, dark store costs and distribution center costs are also covered using these. However, we haven't included those costs to simplify the explanation.

You must be thinking if the situation is that bad, how the Q-Commerce startups are operating?

Before answering this question, there is a fact that you should know almost all of the Q-Commerce startups are not profitable at all, however some startups have claimed profitability in some markets only but the full profitability in such tough unit economics is still a question. But the startups believe in this convenience market and so do the Venture Capitalists. We have to see how the things work out but predicting what the future looks like is still a bit hard as strategies and improvements in the business model are part of the ecosystem.

Considering the whole business model and cash burn rate in the Q-Commerce vertical, what improvements and strategies would you suggest to drive profitability. In the next article, we would be covering the improvements and enhancements that have been adopted by Q-Commerce Startups to enhance their business model. Until then, let us know your thoughts!